I discussed last week that Sony Corp. (NYSE:SNE) has a bright future in cameras. I argued Sony is better off selling its smartphone business - and use the sales proceeds to increase its lead in mirrorless cameras and image sensors. This piece is again to reinforce my thesis why Sony needs to focus more on cameras, not on phones.

Realigning resources to increase its presence in digital cameras ought to be a priority for Sony. Unlike in the smartphone business where Sony competes with hundreds of Chinese firms, the digital camera industry is only dominated by less than a dozen companies.

It makes good business sense to go where Sony has less competition. Aside from Canon (NYSE:CAJ), Olympus (OTCPK:OCPNY), Fujifilm (FUJI), Pentax, and Nikon (OTCPK:NINOY), Sony has no other serious rivals in the DSLR (Digital Single Lens Reflex) camera business.

Furthermore, Sony has an industry-leading image sensor technology. It also has the global brand power to seriously challenge Canon and Nikon. The digital camera business was also predicted to grow to a $19.77 billion/year industry by 2020.

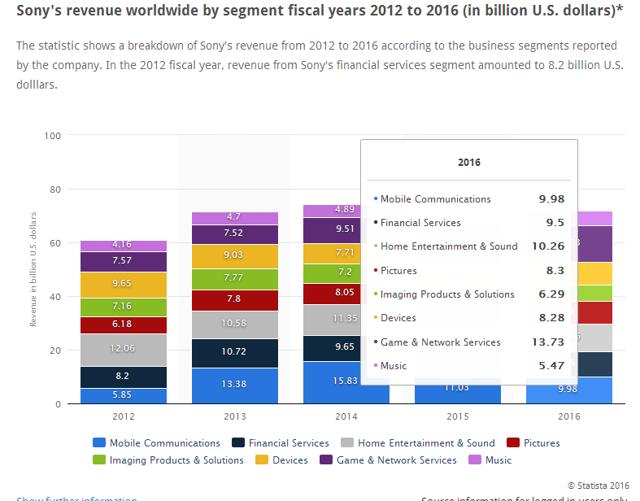

Sony's Imaging Products & Solutions business segment can do better than its current $6.29 billion/year run rate if it could get a bigger slice of the coming $19.77 billion/year digital camera industry.

Click to enlarge

Click to enlarge

(Source: Statista)

Sony has remained a tiny player in the smartphone business. On the other hand, Sony remained as the no.1 brand in mirrorless cameras for four straight years. Sony was a pioneer when it released a full-frame mirrorless DSLR camera in 2013. Sony is also spearheading the rise of high-end bridge or fixed-lens SLR-style superzoom cameras.

The weather-sealed, 4K video recording-capable, 25x optical zoom-capable $1,500 Sony RX10 III bridge camera is the future of prosumer photography and videography. The superzoom/bridge category is Sony's fastest-growing camera segment last year. Sony expects high-zoom cameras to take 45% of the digital camera industry.

Superzoom bridge cameras belong to the fixed-lens category that still dominates sales of digital cameras. Yes, Sony's point-&-shoot compact digital camera is also dying from the rise of smartphones. However, the more expensive bridge camera category will still thrive for many years to come. A smartphone cannot replicate the 25x optical zoom feature and the image quality produced by a Sony RX10 III bridge camera.

Click to enlarge

Click to enlarge

(Source: Sony)

No photographer is ever going to use an iPhone 7 or Galaxy S7 as his main camera to do a wedding or fashion photo shoot job.

Why Sony Leads In Bridge Camera Design

A bridge camera has a DSLR-like size and user interface. It cannot use interchangeable lenses but instead uses a fixed lens with 20x or higher zoom feature. The selling point of a bridge camera is that it is an all-in-one tool that could be used for any purposes. Bridge cameras are good for macro, product photography, wide-angle landscape shoots, portraits, and weddings.

Prior to Sony's entry, the traditional practice was to build sub-$800 bridge superzoom cameras with small image sensors. They produce pictures with image quality that are not as good as those taken with interchangeable-lens DSLR cameras. Sony destroyed this old notion that bridge cameras should only serve as cheaper alternatives that would not match the image quality of interchangeable-lens DSLR cameras.

The 2013 debut (same year Sony released its mirrorless DSLR camera) of Sony's first high-end bridge camera, the mirror-based CyberShot DSC-RX10 was another trendsetter. The high-end image sensor, Bionz processor, Zeiss lens, weather-proof build quality of the RX10 III meant it was a true mid-range prosumer DSLR, but without the hassle of interchangeable lens.

Instead of using a small 1/2.3" image sensor and cheap superzoom lens, Sony decided to use its flagship 1-inch Exmor R BSI image sensor inside the RX10. It's the same sensor used in Sony's flagship mirrorless A7 DSLR. Sony also hired Carl Zeiss to build the superzoom lenses for its bridge cameras from the RX10-series. Sony's idea was to build a fixed-lens DSLR camera that entirely defeats the purpose of the interchangeable-lens DSLR and its required dozen of lenses.

The chart below illustrates why Sony changed the way bridge cameras should be built. The RX10 bridge camera has a 4x bigger image sensor than other bridge cameras. The larger the image sensor is, the better the picture quality is captured.

(Source: cameradecision.com)

The use of a much larger sensor and better zoom lens is why Sony can get away with a $1,500 price tag for its bridge cameras. Other bridge cameras made by Canon, Nikon, Olympus, and Fujifilm are all in the $400-$900 price range. Those cameras have smaller sensors that cannot match the image quality of those pictures taken from a Sony-made bridge camera.

Five years from now, the notion of photographers buying a $1,500 prosumer DSLR camera and spending another $2,000-$3,000 for lenses will become obsolete. It will be more healthy and cost-effective for photographers to just buy Sony's revolutionary RX10 III superzoom (25x optical zoom) bridge camera. The f/2.4-4.0 aperture and 24-600mm versatility of the RX10 lll make it perfect for wedding, debut, event, sports photographers and photo-journalists.

I hope you understand the health risks that we photographers incur when carrying two or three DSLR cameras equipped with heavy (and pricey telephoto zoom Canon) lenses. A 600mm telephoto USM lens from Canon costs $11,499 and it weighs almost 4 kilograms.

Sony wants its high-end bridge camera as a healthy, cheaper, all-in-one solution for photographers.

Bridge Cameras Will Not Cannibalize Sales of Sony's Mirrorless DSLR Cameras

Yes, it is true that Sony sells $3k full-frame, interchangeable-lens mirrorless cameras. Sony also sells its own brand of lenses for them. On the other hand, I do not think that the $1,500 bridge camera RX10 III will cannibalize sales of Sony's flagship A7-series of mirrorless DSLR cameras.

A bridge camera is a crop-frame camera and is therefore not a threat to mirrorless full-frame cameras. To learn more about the differences of crop and full-frame cameras, please go to this link.

The target customers for $1,500 bridge cameras are often not in the league of photographers who buy $3,000+++ full-frame cameras.

Sony is marketing its bridge cameras to a different crowd. People like me who struggle to make money (less than $20k/year gross revenue) on photography are the ideal customers for Sony-made bridge cameras.

I bought a Fujifilm f/2.8 10x zoom bridge camera in 2008 because it was useful for church-related photography services where flash guns are not allowed and changing lenses is often inconvenient. A bridge camera with a large image sensor for low-light photography and 10x/25x zoom is a must for small-time events photographers.

The mirrorless A7-series DSLR from Sony competes with Canon's Mark 5D-7D full-frame mirror-based DSLR products. The RX10-series bridge cameras compete with Canon and Nikon's sub-$2000 crop sensor cameras. Sony saw the opportunity in selling a high-end 24-600mm 25x zoom bridge camera that is far more useful than Canon's 80D or Nikon's D7200. Unlike Canon and Nikon's mid-range cameras, the Sony RX10 III is also a true 4K (3840 X 2160) video recording machine.

Sony's high-end bridge camera therefore also has long-term potential in the emerging market for home-based/small-budget 4K video production. There is a market for gadgets that could simultaneously serve the needs of photographers and 4K-only video producers. Sony's RX10-series of bridge cameras are ideal for people/small firms who create content for the growing population of 4K TV set owners.

The declining price tags of 4K TV sets mean there is a bigger need for content creators to produce more 4K videos/movies. Sony launched a YouTube channel for 4K video content creators last year. It has strong interest in jumpstarting home-based 4K video productions.

Cameras are integral to the overall 4K technology market that's predicted to grow to a $102.1 billion industry by Year 2020.

My Takeaway

I rate Sony as a Buy. Sony already benefits from Canon and Nikon's refusal to release true mirrorless DSLR cameras. Canon and Nikon are also both engaged in selling outdated bridge cameras with sub-par image sensors. Making high-end bridge cameras is simply Sony exploiting the other weakness of its chief rivals.

Canon and Nikon are certainly capable of producing a bridge camera to rival the RX10 III bridge camera. They only refuse to do so for fear of cannibalizing the sales of their own mid-range cameras (and the DSLR lenses for them).

There are few photographers who can afford $3k+++ cameras. I predict that Sony will sell more superzoom bridge cameras than its high-end mirrorless DSLR cameras. The future of mirror-based DSLR cameras is likely going towards Sony's vision in the RX10 III. The interchangeable-lens DSLR market that Canon and Nikon have made so much money from for decades, will gradually become smaller due to high-end bridge cameras from Sony.

Selling 300,000-600,000 bridge cameras (with an average selling price of $1,000) could add $300-$600 million to Sony's Imaging Products & Solutions division.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Source: Sony's High-End Bridge Cameras Are Also A Threat To Canon And Nikon

No comments:

Post a Comment